Exercise / Step 4.6 / Capacity project – Business Plan

Learn how to create a business plan in a professional manner.

You know how to analyze a capacity investment, build the base case, introduce residual value and WCR, and integrate changes in selling prices and costs.

Now, you have to build your whole business plan and make the link between business and financial forecasts (P&L and balance sheet), cash flows and value creation. Showing the results to your Capex controller will very much improve the efficiency of your interaction!

Download and open the frame spreadsheet.

It’s a new case, presented slightly differently, but with the same structure.

First, you get the data.

You need to buy a machine:

![]()

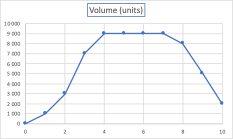

The market volume is not constant: up, stable and down (traditional process):

You are provided with:

- Selling price per unit (and inflation on selling prices)

- Variable cost per unit (and inflation on cost)

- Fixed costs (and inflation on costs – same as variable costs)

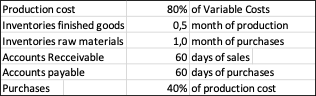

The characteristics of the working capital requirement are:

Last but not least, you need to know the WACC and the tax rate.

Now, you are ready to forecast the financials of your project.

Start with the P&L.

The sales figure in year n is the volume multiplied by the inflated unit selling price (see step 4.5 inflation). The unit selling price in year 0 (when you build your BP) is $300.