Exercise / Step 5 / Productivity

A concrete way to understand the principle of productivity

In order to improve the competitiveness of your production process, you consider replacing an ‘old’ machine by a ‘new’ one which will generate cost savings.

Download and open the frame spreadsheet.

You bought a machine (named machine A) last year for $ 800k whose capacity was adjusted to expected market volumes of 150,000 units during the next 8 years.

One year later, i.e. today, the supplier proposes you to buy machine B (to replace A), because it’s a brand-new technology: you are going to generate cost savings. Machine B is sold for $ 1,050k and will be depreciated over the remaining marketing period, i.e. 7 years. As machine is not that ‘old’, the offer includes a repurchase of A at $ 600k, less than its book value after one year of depreciation.

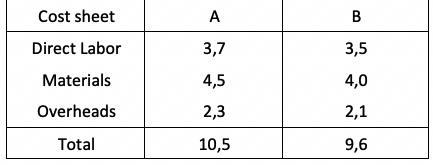

The production costing department provides you with the following information on costs ($ per unit):

The WACC is 8%.

Tax rates are different when you consider selling products (corporate tax rate) or selling a machine (capital gain tax rate). I will explain you why we need different rates.

You are going to calculate, first, the NPV of the decision ‘Buy machine B and sell machine A’.

The first step consists in estimating the net cost of buying ‘B’. There are 3 cash flows:

- Cash out when you pay for B

- Cash in when you sell A

- Cash in when you generate tax savings on the capital loss: you sell A at a price, which is lower than its book value and account for a capital loss; assuming that the firm generates, the same year, a capital gain of, at least, the same amount that would generate tax payment, the capital loss is offsetting the gain and save taxes. You actually save the amount of tax you would have paid of the capital gain: the capital gain tax rate multiplied by the capital gain offset by your capital loss.