Exercise / Step 4.3 : Capacity – Working Capital Requirement

Calculate your working capital requirements

During Step 4.1, you learned how to evaluate the base case and Step 4.2 explained how to consider a residual value at the end of a project.

The next step is somewhat more complex, but crucial, especially when analyzing a capacity investment whose aim is to grow sales.

To increase the sales volume, you need to buy a machine, which increases your non-current (fixed) assets, but another part of your balance sheet is also incremented: the Working Capital Requirement.

Sales are up, then you need to produce more, which increases the inventories.

Sales are up, then, mechanically, accounts receivable are up, i.e. n days of sales outstanding (the famous DSO!).

If you produce more, you purchase more from your suppliers and accounts payable, again mechanically, will increase.

As a consequence, the working capital requirement will go up:

WCR = inventories + accounts receivable (A/R) – accounts payable (A/P)

What the impact on the value creation of the project is the topic of this step.

First, you will measure the impact of the investment on the WCR. First, calculate the evolution of each item, then combine them to estimate the increase in the WCR remembering that there are two ‘+’ signs and one ‘-‘ sign in the WCR.

Second, you will consider that any increase in the WCR is additional funds to raise from capital markets on top of the cost of the machine. So, Io will be transformed into a total cash outlay in year 0 of Io + DWCR.

Let’s interpret this DWCR.

Imagine that you have 1 month of inventories, 2 months of A/R and 2 months of A/P.

In the calculation of the first cash flow, you consider 12 months of production, sales and purchases. In reality, you have produced 13 months of production (and sold 12), collected only 10 months of revenues and paid 10 months of purchases. The DWCR deduction at the beginning of the project is the consequence of that statement. Now, at the end of the project, the opposite happens: you only have to produce 11 months of production, you collect 14 months of sale and pay 14 months of purchases, so it is as if you ‘recover’ the DWCR at the end of the project.

Therefore, to measure the impact of WCR change on the NPV, you will ‘cash out’ the ΔWCR in year 0 and ‘cash in‘ the same ΔWCR at the end of year n.

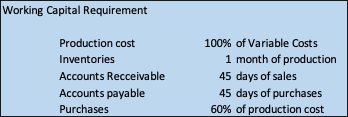

You are provided with the following information in the downloadable spreadsheet: